Upload and attach with your claim after it has been submitted. The wisconsin department of revenue has an unclaimed property You can upload and attach here:

Wisconsin Unclaimed Money (2024 Guide) Unclaimedmoneyfinder

You will need your claim number or confirmation number.

Provide your claim number or confirmation number

The unclaimed property law was enacted in 1970 to enable wisconsin residents to search in one place for missing funds. After one to five years of inactivity, wisconsin businesses are required to turn over all unclaimed money, stock, and safe deposit box contents to the department of revenue. Choosing the correct relationship type and attaching the required documents with your claim will expedite the review and approval of your claim. See relationship types and documentation needed.

You can include up to 20 properties per claim; However, file a separate claim for each property owner. How does property become unclaimed? How do i report and remit unclaimed property to the department?

Why does wisconsin have an unclaimed property law?

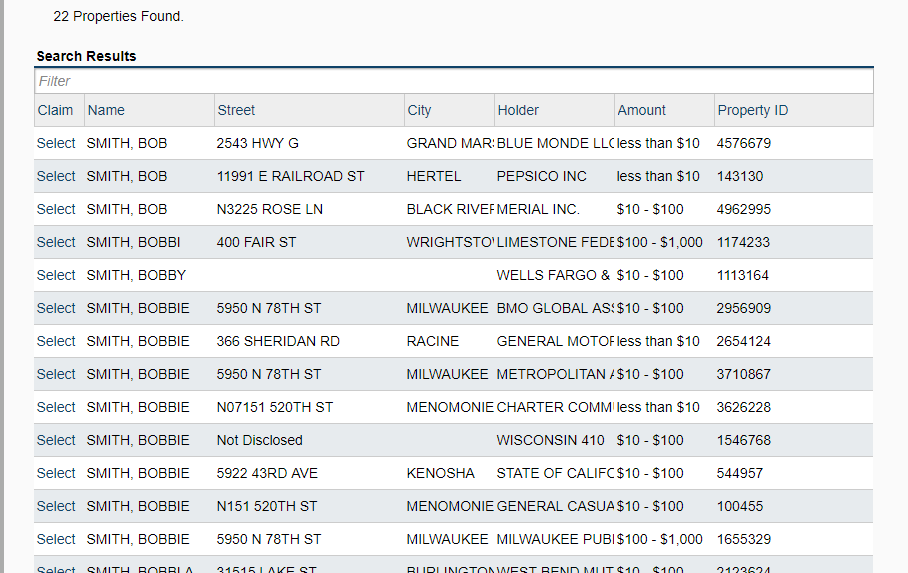

What happens to unclaimed property when the department of revenue cannot locate the rightful owner? Go to the wisconsin department of revenue website's unclaimed property page and click on the search & claim box. There, you can enter your name or business name and see if you have any The state’s commitment to transparency and accessibility ensures that individuals can navigate the process with ease.

The state is currently holding over $600 million in property. You may have unclaimed property and not even know it. You can search and claim your property all on one site, by visiting dor unclaimed property (wi.gov) Missingmoney.com is the official unclaimed property website of the national association of state treasurers.

Us state governments and several canadian provinces, through their partnership with the leading, trusted authority in unclaimed property—the national association of unclaimed property administrators (naupa)—provide this free, safe, and secure site to the public.

We can then change the address on your claim and your refund check will be mailed to that address once your claim is approved. Applicable laws and rules this document provides statements or interpretations of the following laws and regulations enacted as of december 2, 2024: 71.93, 71.935, 177.01, 177.0505, 177.0903 and 177.0905, wis. The office of the state treasurer is responsible for helping to promote the unclaimed property program in wisconsin.

When businesses are unable to return property to the rightful owner, the property gets turned over to the state, and the state holds those assests in trust until the assests can be returned to the rightful owner. If the other owner is still living, you may only be paid your portion of the value of the unclaimed property. The other owner should file their own claim for their portion, unless the other owner is your current spouse, and you filed a joint return in the past year. Your business is the owner of the property, and your business name appears on the property record and your business has all rights to the ownership of the property.

You have been appointed by a judge to take care of a minor child (called a ward) or incompetent adult personally and/or manage that person's

Once the property is designated as unclaimed, wisconsin takes several steps to reunite property with its owners by: Advertising unclaimed property and its owner; Matching the names of unclaimed property owners with information from the public record; Using tax records to try to locate unclaimed property owners;

Information contained in the naupa qrp states unclaimed property monitoring service is for informational and reference purposes only. This information may not be copied or reproduced in any capacity without the express written consent of the national association of unclaimed property administrators®. Upload and attach directly with your claim submission; Upload and attach with your claim after it has been submitted.

You can upload and attach here:

You will need your claim number or confirmation number. Provide your claim number or confirmation number The unclaimed property law was enacted in 1970 to enable wisconsin residents to search in one place for missing funds. After one to five years of inactivity, wisconsin businesses are required to turn over all unclaimed money, stock, and safe deposit box contents to the department of revenue.

Choosing the correct relationship type and attaching the required documents with your claim will expedite the review and approval of your claim. See relationship types and documentation needed. You can include up to 20 properties per claim; However, file a separate claim for each property owner.

How does property become unclaimed?

How do i report and remit unclaimed property to the department? Why does wisconsin have an unclaimed property law? What happens to unclaimed property when the department of revenue cannot locate the rightful owner? Go to the wisconsin department of revenue website's unclaimed property page and click on the search & claim box.

There, you can enter your name or business name and see if you have any The state’s commitment to transparency and accessibility ensures that individuals can navigate the process with ease. Asset holders are expected to report unclaimed property to the dor by filing an unclaimed property report using this guide. The dormancy period, when the state becomes the custodian of unclaimed assets, is between one and five years, depending on the asset.

There are several ways to find out if you have missing money, including visiting one of your state’s official unclaimed property outreach events.

You can also find out immediately by using one of two key online search resources. Missingmoney.com is the official unclaimed property website of the national association of state treasurers. Us state governments and several canadian provinces, through their partnership with the leading, trusted authority in unclaimed property—the national association of unclaimed property administrators (naupa)—provide this free, safe, and secure site to the public. Search for your unclaimed property (it’s free) claim your found property;

Reporting software and naupa file format; Become a member of naupa The state’s commitment to transparency and accessibility ensures that individuals can navigate the process with ease. Property tax bill or lease;

If you move after your claim is filed, upload proof of your new address to your claim by using the submit additional claim documents link.

Proof of address associated with the property being claimed. Driver's license or state id; Many people who have unclaimed cash don't realize it, whether it's money owed from pension funds, business refunds, or other sources.