Alright, let’s cut straight to the chase. If you’ve stumbled upon the term “768 code IRS,” you’re probably in for a wild ride. This mysterious number isn’t just a random sequence; it’s a code issued by the Internal Revenue Service (IRS) that can have serious implications for your finances. Whether you’re a small business owner, a freelancer, or even a regular employee, understanding what this code means could save you from some serious headaches. So, buckle up, because we’re about to break it down in a way that even your grandma could understand. Don’t worry, I’ll keep it casual and fun.

Now, you might be wondering, “Why should I care about the 768 code IRS?” Well, my friend, the IRS doesn’t play games. This code often pops up when there’s an issue with your tax filings, and ignoring it could lead to penalties, interest, or even worse—audit land. Yikes! But fear not, because by the end of this article, you’ll be an expert on what this code means, how it works, and, most importantly, what you can do about it.

Before we dive deep into the nitty-gritty, let’s set the stage. Tax codes are like the IRS’s secret language, and they use them to communicate important messages about your tax situation. The 768 code IRS is no exception. It’s like a little red flag that says, “Hey, something’s not quite right here.” But don’t panic yet. Sometimes, it’s just a simple misunderstanding or clerical error. Let’s figure it out together, shall we?

What Exactly Is the 768 Code IRS?

Let’s start with the basics. The 768 code IRS is essentially a notification or alert from the IRS that there’s an issue with your tax return. Think of it as a heads-up that something in your filing process needs attention. It’s not necessarily bad news, but it does mean you need to take action. The IRS uses these codes to streamline their communication with taxpayers, making it easier for them to pinpoint specific problems.

Now, here’s the kicker: the 768 code IRS isn’t always the same for everyone. Depending on your situation, it could mean different things. For instance, it might indicate a mismatch in your income reporting, an incorrect Social Security number, or even a missing form. The key is to understand what the code means in your particular case and address it promptly.

Why Does the IRS Use Tax Codes?

The IRS loves its codes, and for good reason. These codes help them manage millions of tax returns efficiently. Imagine trying to sort through all those filings without a system—it’d be chaos. Tax codes like the 768 code IRS act as shortcuts, allowing the IRS to quickly identify issues and notify taxpayers. It’s like a digital breadcrumb trail that leads you straight to the problem.

But why does the IRS need so many codes? Well, taxes are complicated, and there are tons of rules and regulations to follow. By using codes, the IRS can categorize issues more effectively. For example, one code might signal an issue with your deductions, while another could point to a problem with your credits. The 768 code IRS is just one of many tools the IRS uses to keep things organized.

Breaking Down the 768 Code IRS

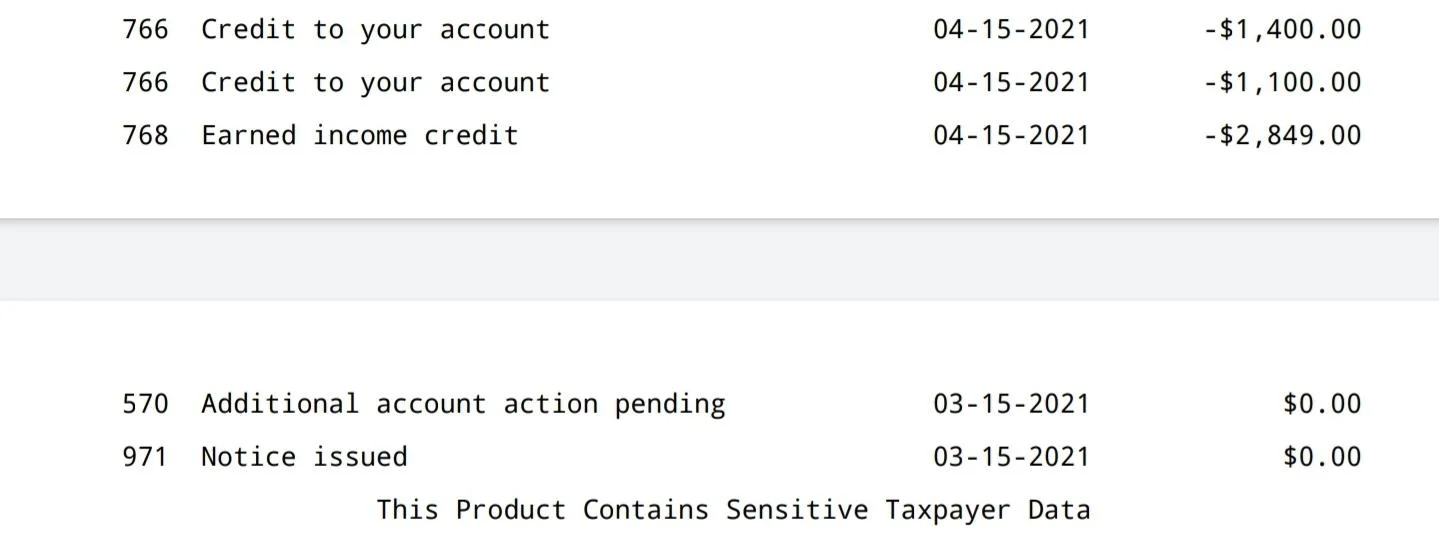

Alright, let’s get into the details. The 768 code IRS typically relates to discrepancies in your tax filings. This could mean anything from a typo in your Social Security number to a mismatch in your income statements. Here’s a quick rundown of what the code might signify:

- Incorrect or incomplete information on your W-2 or 1099 forms.

- A discrepancy between your reported income and what your employer or financial institution reported to the IRS.

- An issue with your tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit.

- Potential identity theft or fraud involving your tax information.

See? It’s not all doom and gloom. Sometimes, it’s just a simple fix. But hey, it’s always better to be safe than sorry.

How Does the 768 Code IRS Affect You?

Now, let’s talk about the impact. If you receive a notice from the IRS with the 768 code, it’s important to take it seriously. Ignoring it won’t make it go away; in fact, it could lead to bigger problems down the road. Here’s what you might face if you don’t address the issue:

- Penalties and Interest: The IRS isn’t shy about charging penalties and interest on unpaid taxes. If the issue is related to underpayment, you could end up paying more than you originally owed.

- Audit Risk: If the IRS suspects something fishy, they might decide to audit you. Audits are no fun, and they can be time-consuming and stressful.

- Delayed Refunds: If you’re expecting a tax refund, the 768 code IRS could hold it up until the issue is resolved.

But here’s the good news: most issues can be resolved with a little effort. It’s all about taking the right steps at the right time.

Steps to Resolve the 768 Code IRS

So, you’ve received a notice with the 768 code IRS. What now? Don’t panic—there’s a process you can follow to get things sorted out. Here’s a step-by-step guide:

- Review the Notice: Carefully read the IRS notice to understand what the issue is. It might seem confusing at first, but take your time and break it down.

- Gather Your Documents: Collect all your tax-related documents, including W-2s, 1099s, and any other forms you submitted. This will help you verify the information and identify any discrepancies.

- Contact the IRS: If you’re unsure about the issue or need clarification, don’t hesitate to reach out to the IRS. They have dedicated phone lines and resources to assist taxpayers.

- Consult a Tax Professional: If the issue seems complex, it might be worth hiring a tax professional. They can help you navigate the process and ensure everything is resolved correctly.

Remember, the sooner you address the issue, the better. Procrastinating won’t make it disappear; it’ll only make it worse.

Common Mistakes to Avoid

While resolving the 768 code IRS, there are a few common mistakes you should avoid:

- Ignoring the Notice: This is a big no-no. Ignoring the IRS won’t solve anything; it’ll just create more problems.

- Making Assumptions: Don’t assume you know what the issue is without verifying the facts. Take the time to review your documents and understand the situation fully.

- Overpaying Taxes: Some people panic and send extra money to the IRS, thinking it’ll solve the problem. Always verify the exact amount you owe before making any payments.

Stay calm, stay focused, and you’ll get through it.

Preventing Future Issues

Once you’ve resolved the 768 code IRS, it’s time to think about prevention. Here are some tips to help you avoid similar issues in the future:

- Double-Check Your Filings: Before submitting your tax return, make sure all the information is accurate and complete. A few extra minutes of proofreading could save you a lot of trouble.

- Use Tax Software: Modern tax software can help you catch errors before you submit your return. Many programs also offer free support and guidance.

- Stay Organized: Keep all your tax documents in one place and update them regularly. This will make the filing process smoother and reduce the risk of errors.

Prevention is key. The more proactive you are, the less likely you are to encounter issues like the 768 code IRS.

Understanding IRS Notices and Letters

Not all IRS communications are created equal. The 768 code IRS is just one example of the many notices and letters the IRS sends out. Here’s a quick overview of what you might encounter:

- CP Notices: These notices deal with changes to your account, such as adjustments to your tax liability or refunds.

- LT Letters: These letters often relate to specific tax issues, such as missing forms or discrepancies in your filings.

- PL Notices: These notices are usually related to penalties or interest charges.

Each notice or letter has its own purpose and requirements, so it’s important to understand what you’re dealing with. Don’t hesitate to ask for help if you’re unsure.

How to Respond to IRS Notices

Responding to IRS notices can be intimidating, but it doesn’t have to be. Here’s how to handle it:

- Read Carefully: Make sure you understand what the notice is saying and what action, if any, is required.

- Gather Information: Collect all relevant documents and information to support your response.

- Respond Promptly: Don’t miss any deadlines. The IRS usually provides a specific timeframe for responding, so make sure you meet it.

Responding correctly and on time can make a huge difference in resolving any issues.

Data and Statistics on IRS Tax Codes

Did you know that the IRS processes over 240 million tax returns each year? That’s a lot of data to manage, and tax codes play a crucial role in keeping things organized. According to recent statistics:

- About 20% of tax returns contain errors that trigger IRS notices or letters.

- The most common issues involve income reporting, deductions, and credits.

- Over 10 million taxpayers receive IRS notices annually, with codes like the 768 code IRS being among the most common.

These numbers highlight the importance of accuracy and attention to detail when filing your taxes. Even the smallest error can lead to big problems.

Conclusion

Alright, we’ve covered a lot of ground here. Let’s recap the key points:

- The 768 code IRS is a notification from the IRS that there’s an issue with your tax filings.

- It’s important to take action promptly to avoid penalties, interest, or audits.

- By following the steps outlined in this article, you can resolve the issue and prevent future problems.

Remember, knowledge is power. The more you understand about tax codes and IRS communications, the better equipped you’ll be to handle any issues that come your way. So, go forth and conquer those taxes! And don’t forget to share this article with your friends and family. Who knows? You might just save someone else from a tax headache.

Table of Contents

- What Exactly Is the 768 Code IRS?

- Why Does the IRS Use Tax Codes?

- Breaking Down the 768 Code IRS

- How Does the 768 Code IRS Affect You?

- Steps to Resolve the 768 Code IRS

- Common Mistakes to Avoid

- Preventing Future Issues

- Understanding IRS Notices and Letters

- How to Respond to IRS Notices

- Data and Statistics on IRS Tax Codes